Although the supply chain crisis seems to have eased, another trouble is about to begin.

There are various signs that the worst period of the global supply chain crisis has passed, and ocean freight and the number of stranded containers are gradually declining.

However, according to Bloomberg analyst Mark Cudmore, the aftermath of the global supply crisis still spreads in areas closely related to it, and is intertwined with factors such as the energy crisis and extreme weather, which will soon lead to a food crisis next year.

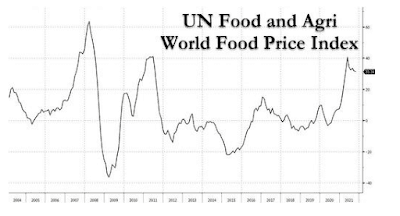

Global food price index sets record, major crop prices soar

Data show that the problem of global food inflation is getting worse.

According to data from the Food and Agriculture Organization of the United Nations (FAO), the average food price index in October was 133.2 points, up 3% and 31.3% month-on-month and 31.3% year-on-year.

The index rose for three consecutive months and reached its highest level since July 2011 in October.

The Bloomberg Commodity Agriculture sub-index has risen by more than 80% from last year's low. The last surge occurred during 2010-2011.

Looking further, as the main raw materials of food, the prices of global crops are rising rapidly, the most typical of which are wheat and coffee beans.

Wheat futures prices started in early November for the longest consecutive monthly increase since 2007. This year's harvests in several major exporting countries have been affected by bad weather, demand for wheat has surged, and buyers around the world are chasing limited supply.

The International Grains Council warned last week that stocks in major exporters of milling wheat could fall to a nine-year low. In addition, tensions in Russia and Ukraine, the two largest wheat producing countries in the world, have increased, adding uncertainty to the future supply of wheat.

The price of Arabica, one of the main varieties of coffee beans, has doubled in the past year. Major producing countries such as Brazil encountered extreme weather, and coffee production was severely damaged. Cudmore said it would take years for production to resume.

Dave MacLennan, CEO of Cargill, the global agricultural trade giant, said that food inflation will not be temporary, and food prices will continue to rise next year.

Crises intertwined and evolved into a food crisis

Extreme weather has always been the main catalyst for rising food. Since the beginning of this year, droughts in North and South America and heavy rains in Europe and Asia have caused crop failures, and the global output of wheat, coffee beans, and sugar cane have all been affected.

Against the background of global warming, extreme weather and natural disasters occur frequently, and crop production is threatened.

For more than a year, multiple links in the global food supply chain have been blocked by the outbreak. Although the current supply chain problems have eased, the crisis is far from over. Shipping costs are still at a high level compared to the same period last year, and ship congestion has not been significantly reduced.

The Baltic Freight Index showed that freight rates rose by about 5% last week, and the freight rate per 40-foot container was about US$14,700, which is still more than three times the level of the same period last year.

Due to the shortage of containers and the grounding of passenger planes, the transportation of fresh fruits and vegetables is still a problem. Although grain and sugar can be transported in bulk by large ships, the capacity is also limited.

The labor shortage caused by the epidemic has caused delays in food production. MacLennan said that the continued shortage of the labor market is one of the most closely watched supply chain inputs for the industry.

The energy crisis has directly exacerbated the food supply problem. The price of natural gas has skyrocketed some time ago, pushing up oil and fertilizer prices, and increasing the cost of food transportation and production.

Although entering in November, crude oil has flattened the increase since October. In the short term, oil prices are unlikely to fall rapidly. In addition, according to Goldman Sachs' forecast, the Fed's release of crude oil reserves will bring upside risks to the oil price forecast in 2022.

As for chemical fertilizers, data shows that India's potash contract pricing has skyrocketed by 59%. Potash fertilizer prices in Europe rose by 1.7%, the highest increase since 2015. The U.S. North American Fertilizer Price Index hit a new high for three consecutive weeks.

Soaring food prices are just the epitome of inflation

As an indispensable indicator of CPI, soaring food prices are just a microcosm of inflation.

The 5-year break-even inflation rate in the United States has risen above 3%, the first time in 19 years. The UK's 5-year break-even inflation rate rose above 4%, the first time in 25 years.

Cudmore said that it is more important now to determine whether demand will dominate inflation, so inflation expectations are critical.

He also said that it is good to know when supply pressure will ease, but the current situation is not enough to determine when the inflation threat will pass.

No comments:

Post a Comment